unrealized capital gains tax meaning

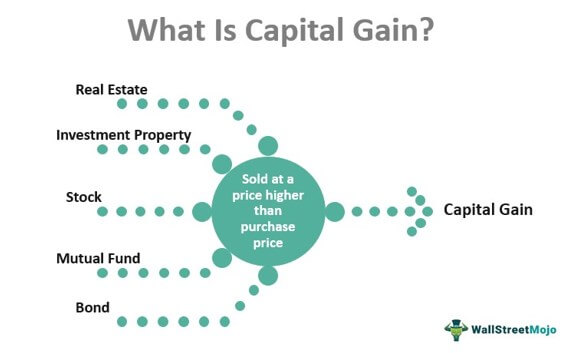

A capital gain occurs when you sell an asset or investment at a higher value than its original purchase price meaning you earn income from the sale. A small amount of tax was paid in 2010 and 2011 because of the flowthrough interest income reported in.

Capital Gains Tax For Individuals Not Resident In The Uk Low Incomes Tax Reform Group

Just as with individual securities when you sell shares of a mutual fund or ETF exchange-traded fund for a profit youll owe taxes on that realized gain.

. What are capital gains. Assume that ordinary income loss will be taxed at a federal rate of 33 42 and long-term capital gains and dividend income will be taxed at 15. Funds buy sell too.

They already tax property owners on unrealized capital gains. This also assumes an applicable state tax rate of 5 43 and excludes the effects of the AMT. This applies to stocks.

Report short-term gains or losses in Part I. Real property interests by foreign persons. Report long-term gains or losses in Part II.

Real property interest the buyer or other transferee may have to withhold income tax on the amount you receive for the property including cash the fair market value of other property and any assumed liability. The holding period for long-term capital gains and losses is generally more than 1 year. Every time the government declares that your property has increased in value they increase your taxes on the property even though you have not received any money from the increase in your property value unless you sell it at that higher value of course.

If you are a foreign person or firm and you sell or otherwise dispose of a US. Capital gains made by investments in a Tax-Free Savings Account TFSA are not taxed. A Capital gains tax was first introduced in Canada by Pierre Trudeau and his finance minister Edgar Benson in the 1971 Canadian federal budget.

The holding period for short-term capital gains and losses is generally 1 year or less. But you may also owe taxes if the fund realizes a gain by selling a security for more than the original purchase priceeven if you havent sold any shares. Some exceptions apply such as selling ones primary residence which may be exempt from taxation.

By law the fund must pass on any net gains to. However an exception applies for certain sales of applicable partnership. It instead takes a firms earnings and adjusts it by adding in depreciation and amortization then reducing working capital changes and expenditures.

While EBITDA demonstrates a companys earning potential after removing essential expenses like interest tax depreciation and amortization free cash flow is unencumbered.

Capital Gains Tax On Gifts Low Incomes Tax Reform Group

Capex Planning In 2022 Financial Management Accounting Books Capital Expenditure

Capital Gain Tax In The Netherlands

The Unintended Consequences Of Taxing Unrealized Capital Gains

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

No U S Won T Tax Your Unrealized Capital Gains Alexandria

Capital Gains Tax In The Netherlands

Should I Disclose Profits As Capital Gains Mint

Capital Gain Formula And Taxes On Unrealized Realized Gains

Capital Gain Formula And Taxes On Unrealized Realized Gains

Capital Gains Tax What Is It And How It Applies To Your Crypto Coinbase

Capital Gain Tax In The Netherlands

Crypto Tax Unrealized Gains Explained Koinly

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube